Ever seen a slanted head and shoulders pattern and didn’t recognize it? It’s happened to me time and again! But what helped me most times are other trading concepts I know such as price action trading using candlesticks, order blocks, pivots, and so much more. However, mastering the art of trading with the diagonal head and shoulders pattern will prove useful in the long run. You’ll know where to enter and exit your trades and the best places to set your stop loss to manage risk.

What can you expect from this guide? Look forward to discovering how the sloped head and shoulders pattern works, good tilted head and shoulders pattern examples, and how to interpret the formation as bullish or bearish. I’ll also delve into other technical and fundamental concepts that could influence this formation. You might do well to save this learning guide as a PDF for future reference. I’ve also covered how to earn passive income with cryptocurrency and 5 best cryptos to buy now. Do well to check them out!

What is a Slanted Head and Shoulders Pattern?

Stand in front of a mirror and bend your head and ONE of your shoulders downwards to the right or left. What do you see? Hopefully, it’s a reflection that is similar to a tilted head and shoulders pattern. Lol.

Anyways, this is a sloped structure that differs from the traditional pattern where both shoulders have the same base called a neckline.

A slanted head and shoulders pattern is a formation where the neckline tilts upwards or downwards. It is diagonal! This setup is caused by either:

- One of the shoulders is significantly higher than the other instead of both hitting almost the same level of support or resistance.

- Failure or success of a lower low to be formed in a changing uptrend or higher low to be formed in a changing downtrend.

Now don’t worry too much as this explanation as it gets simpler once you understand how to trade this pattern.

The neckline would often act as a support or resistance before and after a breakout. Here are examples of what each scenario before a breakout and after a breakout.

Example 1: This is a slanted head and shoulders pattern with the neckline acting as support. Notice how we don’t have a perfect head formation since there is a double top as a head. This means that you should expect variations of this pattern as you trade.

In Figure 1, the slanted pattern is created by the formation of a higher low on the second shoulder instead of the same lows.

Example 2: This is a slanted head and shoulders pattern with a retest of the neckline. The neckline is now acting as resistance adhering to the concept of previous support becoming resistance. Price would either change its trend (from uptrend to downtrend) if the resistance is strong or continue its trend if the resistance is weak.

In Figure 2, the resistance is temporarily weak as a candle closes below it and several candles can’t trade above the level.

However, one momentum candle pierces through this resistance and the trend continues. It can be assumed that a lot of buy orders were below this resistance level, propelling the price higher, which made the pattern serve as a continuation pattern instead of a reversal one.

Example 3: This is a slanted inverse head and shoulders pattern with the neckline acting as resistance. Interestingly, multiple candles are closing above this neckline. However, the rule of drawing support or resistance lines is to choose a level where most candles are hitting or a level very close to most candles. Thus, I’ve drawn the neckline to be closer to as many price peaks as possible as shown in Figure 3.

Example 4: In Figure 4, the neckline is now acting as a support adhering to the concept of previous resistance becoming support. But notice how support was rejected after the retest on the second candle. The market however consolidated for a while below this neckline, gaining more buyers/strength to finally breach the resistance and sustain the move upwards above the level.

What can you take from this price action?

- Necklines can be breached immediately or at a later time.

- Price can consolidate below or above necklines before moving in the opposite direction.

Example 5: Figure 5 is a regular head and shoulders pattern with slightly tilted neckline. You’ll notice how the troughs of the first and second shoulders hit at the same support level before a breakout and retest of the new resistance.

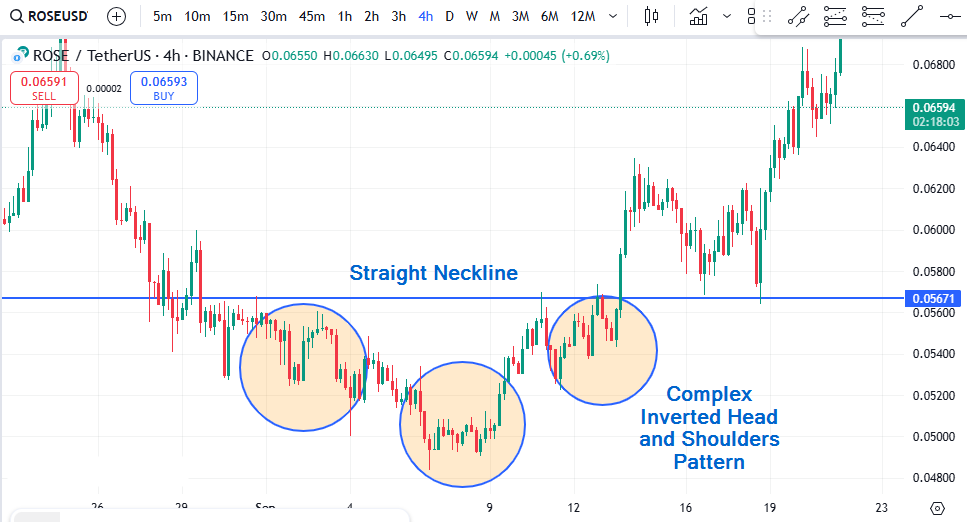

Example 6: Figure 6 is a straight neckline of a typical inverted head and shoulders pattern. This is a complex pattern since we have multiple shoulders forming a single shoulder. On a higher timeframe such as 1-day, this complexity might not be evident. Hence, lower timeframes will show you more price action and potential entries/exits/take profit points.

Now that you’ve seen different structures of the diagonal and regular head and shoulders pattern, you’d agree that this is a reversal pattern. Price has a higher chance of breaking out in the opposite direction once it closes below or above the neckline. But not in all cases!

Therefore, let me show you how to spot and trade the titled head & shoulders pattern and determine which direction it could potentially break. Your ability to spot these patterns early will ensure you maximize them to improve your trading strategy.

How to Trade the Slanted Head and Shoulders Pattern

Pay attention to the following to be able to trade the slanted head and shoulders pattern.

1. Find the First Shoulder

In an uptrend, the first shoulder of a head and shoulders pattern would form a high. This can be a higher high from a previous high, as shown in Figure 7 below.

However, you won’t be certain that this is the start of the pattern from seeing just the first shoulder. Nonetheless, if you notice a reduction in volatility while price is an uptrend, then it could be the start of the pattern. This is because the pattern is a consolidation structure where price takes a rest before finding a new direction.

Ask yourself these questions:

Have buyers suddenly become less enthusiastic that the candles are becoming smaller and closer together?

Is the trend direction beginning to curve instead of slanting indicating that the strong trend is becoming weak?

In the same vein, has the corrective move become larger? such as 75% of the impulse move (a move in the same direction as the prevailing trend) when it was often 25% to 50% of the entire move.

As shown in Figure 8, the corrective moves (moves against the trend) were often between 25% and 50%. However, at some point, it became 75%. Such a large correction should make you question the strength of the trend, The stronger the pullback, the less stronger the trend.

2. Find the Head

The head of the pattern would often be a higher high in an uptrend or lower low in a downtrend. However, its distance from the head is often a short one.

You might want to measure the length of the previous impulse moves compared to the current head and you’d be able to spot is formation early.

Impulse moves are price surges in line with the trend.

As shown in Figure 9, it’s an uptrend and the upward (impulse) moves were often longer but became short when the first head was formed. The same short move is evident in the head, indicating a correction.

This head would also often lean sideways to the first head instead of directly upwards or downwards. Thus, the formation may become rounded or oval as shown in Figure 10.

3. Find the Second Shoulder

The second shoulder of this pattern is a lower high in an uptrend and higher low in a downtrend.

Here, the trend is changing given the new structure that is being formed.

Recall that the previous structure was higher highs (first shoulder, and head in an uptrend) but now we have the first lower high. Same way there were low lows in a downtrend until our first higher low.

But the trend has not CHANGED! It is CHANGING! These are two different things.

The candle close below (in a changing uptrend) or above (in a changing downtrend) is the confirmation that the trend has CHANGED!

4. Draw a Common Base

Draw a line connecting the lows/troughs of the first shoulder, head, and second shoulder.

This line would typically be slanted or diagonal, and it is the neckline.

In my opinion, the neckline is the most important part of this formation since its breach can change the trend. This means an inability to breach this neckline would see it act only as a support or resistance depending on its strength.

So, what determines the strength of the neckline or generally, a support level or zone?

The following does:

The number of buyers at the level or zone in an uptrend. The higher the buyer’s aggression, the higher the potential for the neckline to hold as support.

The number of sellers at the level or zone in an uptrend. The higher the seller’s aggression, the more likely the neckline will hold as resistance.

5. Wait for a Breakout

A breakout is when a candle closes below the neckline (in an uptrend) or above it (in a downtrend).

You should spot this candle closes on higher timeframes such as 4 hours, 1 day, 1 week, or 1 month.

That’s because the higher the timeframe the candle closes, the higher the potential for price to reverse in the new direction.

However, neckline breakouts on lower timeframes can prove useful if you’re scalping or entering and closing your trades on the same day.

But for long and medium-term trend reversals, look for neckline breakouts on higher timeframes.

You don’t want to get stuck in a false break or breakout because you entered positions too early.

6. Wait for a Retest

There might have been a breakout, but false breakouts happen every now and then.

Therefore, wait for a retest of the neckline before making an entry.

This reduces your risk for a loss especially if the breakout was due to fundamental news such as Federal Reserve’s interest rate decision, US elections, crypto adoption, etc.

It is also important to note that price may not always retest the breached neckline before advancing in its new direction. There are cases where high volume/volatility would sustain price in the new trend for hours, days and even weeks.

Nonetheless, your goal should always be to manage risk first before profit.

You can find consolidation regions on the lower timeframe to place your stop loss if you’d rather take the trade immediately after a breakout

7. Estimate Price Target

So you’ve made an entry, what next? I just had an idea, how about you measure the distance of the pattern’s head to the neckline. This distance will be used to forecast the extent of the move from the neckline.

Usually, price moves atleast the size of this distance after a breakout, thus, you might want to use it to determine your risk to reward.

You should aim for atleast 1:2 risk to reward which means your profit could be twice your loss.

The image below shows how you can measure the risk to reward on Tradingview using the R:R tool. Simply place the entry at the start point and drag up in the new downtrend or upwards in the new uptrend.

Even without the R:R tool, you can use the estimated move after breakout as your profit target and then gradually adjust your stop loss as price extends from the profit target.

Example of How to Trade Slanted Head and Shoulders Pattern

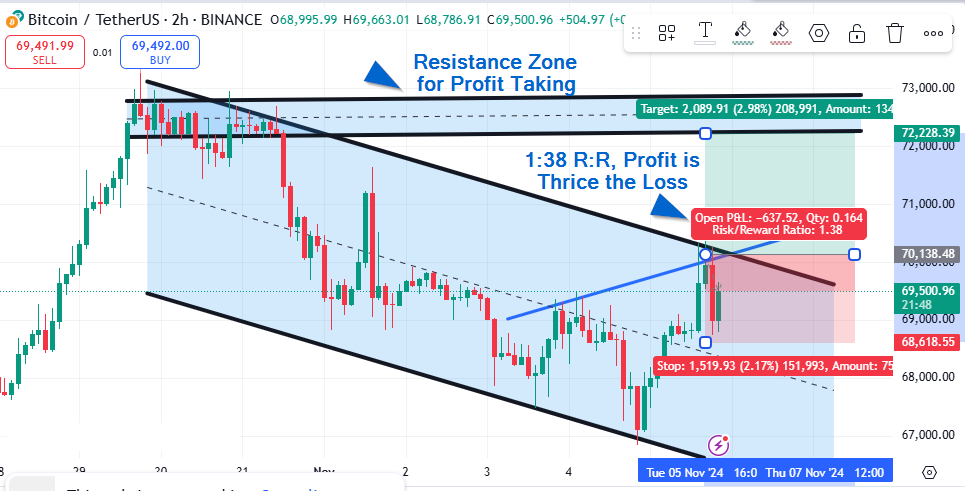

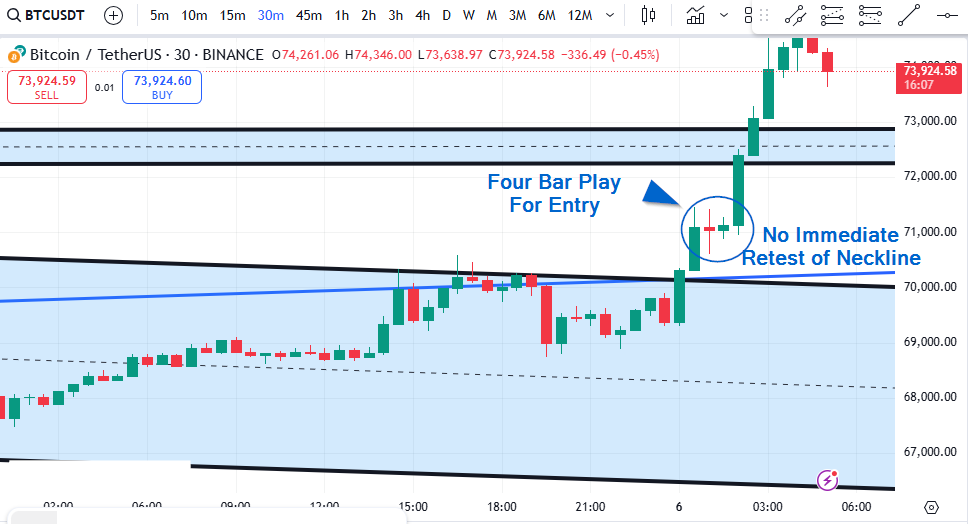

Here is an example where I spotted the slanted inverse head and shoulders pattern early on a BitcoinUSDT chart.

This is a 2-hour chart, where the first shoulder and head have fully formed. However, the second shoulder is in formation. Notice how the chart is inverted since this is a downtrend.

The first clues to spotting this pattern were:

- Reduced length of the impulse moves.

- Increased length of the corrective move especially around the head region. The corrective move becomes longer than the impulse moves.

- Potential formation of a higher low instead of a lower low, which is the current trend.

Now that I have spotted the pattern early, I need to prepare for entry by knowing the following:

- Entry point. This is after a breakout of the neckline and a retest of this neckline. I’ve also drawn a channel around the trend to find a confluence. Here, the channel’s resistance is inline with t

- Stop loss region. I often like to use a tight stop loss. Hence, I’ll set my stop loss a small distance away from the low of the previous candle. Giving a gap away from the candle’s low ensures I don’t get stopped out easily due to false breaks.

- Exit Point. The resistance zone is where I’ll look to take profit. This is the zone where the strongest selling pressure would take place before price either yields to the pressure and retraces a bit or breaks out of the region. Nonetheless, my goal is to profit and not wait around to see what happens.

Now I’ve used a risk-to-reward tool to determine if this trade is worth the risk. At 1:38 R : R, I’d say it is. That’s because, for every potential loss, I could make thrice the amount. Hence, even if I’m stopped out thrice, and the fourth trade is profitable, this would be a breakeven trade but neither a profit nor loss.

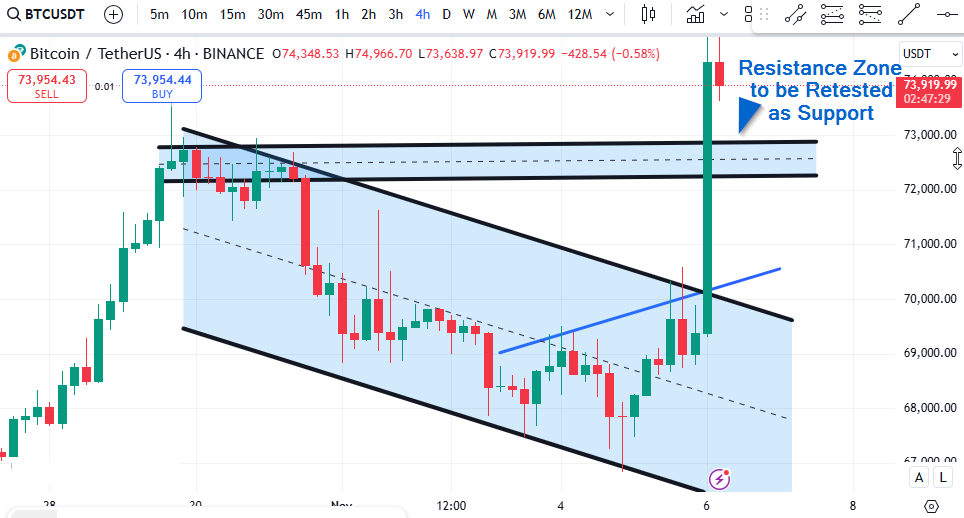

The image below emphasizes using multiple timeframe analysis to take your entries even when trading chart patterns.

The sloped inverse head and shoulders pattern was spotted on the 2-hour timeframe, however, I narrowed it down to the 30-minute timeframe (TF) where I could notice a breach of a trendline. Thus, this lower TF also confirms taking an immediate entry into the trade would not be ideal.

Note: My choice of the 30 minutes timeframe is based on a Factor of 4. Where you multiply the lower timeframe by 4 (or 6 for a Factor of 6) to know the ideal higher timeframe. 30 x 4 yields 120 minutes which is 2 hours.

Also, taking the trade after the trendline has been reclaimed as support would mean I’m trading close to resistance, given the neckline and falling channel’s resistance.

So, how did the market turn out five hours later?

Bitocin made a significant move from $70,000 to $75,000 which signified an all-time high price for the digital asset. This swift move to my take profit target of $73,000 could largely be tied to the ongoing US 2024 presidential election, at the time of writing. And the gwoing excitment that Donaly Trump had more electoral votes and could emerge winner.

Due to this strong fundamental event, volatility was quite high and preventing price from consolidating around the neckline for days, as would often be the case. Looking at the chart closely, you’d notice that there was no immediate retest to gain an entry. Rather, a four bar play candle formation hinting on a bullish move.

Thus, this surge reemphasizes that if volaitlity is strong, immediate retest may not happen immdiately. Does that mean we can expect this retest around $71,000 at a latter time? Yes. This post will be updated accordingly when the neckline is revisted as support. But for now, the resistance zone would act as support as the next few candles try to gather buy others to extend price further into a discovery zone.

Questions

Here are answers to some frequently asked questions about head and shoulders pattern

1. Can a head and shoulders pattern be slanted?

Yes, this formation can be slanted. As explained in this post, the strength of the trend could cause a slant. Such as in an uptrend, a second shoulder is formed but still higher than the low of the first shoulder. There can also be cases where the second low is lower than the first shoulder’s low.

2. Can a Head and Shoulders Pattern be Bullish?

Yes, a head and shoulders pattern can be bullish if it appears at the end of a downtrend.

This pattern signifies a reversal of the current trend and the reversal is confirmed on a breakout of the neckline.

Similarly, this pattern can be bearish if it occurs in an uptrend, indicating a potential change in trend.

3. Does the head and shoulders pattern work?

All chart patterns have a degree of accuracy in correctly predicting a change in trend. However, none has a 100% degree of precision in this prediction. The slanted head and shoulders pattern has a 70% to 75% potential of reversing a trend.

In my opinion, this percentage is a high one to take trades off this formation. However, combine your analysis with multiple timeframe analysis, candlestick patterns, and even fundamental analysis.

This combined analysis would improve the potential of the trade going in your favor.

Conclusion

The slanted head and shoulders pattern can be bullish or bearish depending on the trend its found. It’s a bearish pattern in an uptrend since it hints of a reversal into a downtrend. Conversely, this pattern predicts a reversal into an uptrend in an extended downtrend. You know the simple steps to discover this pattern and trade the formation profitably. Therefore, study these tips by practicing on a chart until you master the technique.